Environmentally Friendly Finance

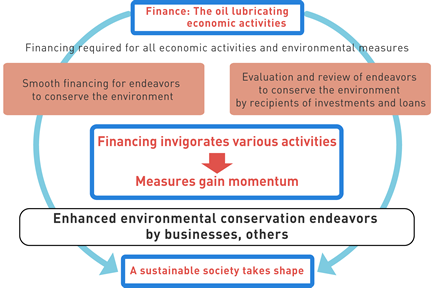

Economic activities of every type in our society are conducted using money as a medium, and flows of money have a pronounced impact on our social institutions. Under the circumstances, altering fund flows so that they become compatible with a sustainable society will be crucial for changing the social setup into one that is sustainable.

By applying appropriate environmental incentives through financial markets, environmentally friendly finance (green finance) serves as a mechanism inducing companies and individuals to adopt behavior taking the environment into consideration.

With the rise of environmental consciousness, moves toward green finance have been spreading in Japan in recent years. These moves need to be stepped up in the management of Japan’s personal financial assets, which are in excess of \1.4 quadrillion. The flow of money into the creation of a sustainable society needs to be encouraged still more.

Roles of Green Finance

The specific roles of green finance fall mainly in the two following groups:

(a)a.Investments and loans for supplying funds used directly in projects to reduce environmental burden

(b)b.Investments and loans for evaluating and supporting economic organizations that seek to encourage environmentally friendly corporate behavior and for promoting similar arrangements

Among the specific endeavors in group (a) are investments and loans for assorted types of environmental projects, financing for investment in environmental facilities, investments and loans for environmental venture businesses, and provision of insurance services for risks related to the environmental business.

Among the specific endeavors in group (b) are environmental-rating financing and responsible investment (RI), practices that provide incentives for environmentally friendly behavior by assessing from the environmental perspective the activities of companies receiving investments and loans and reflecting those assessment results in investment and loan operations.

International Links

United Nations Environment Programme Finance Initiative(UNEPFI)

This is a partnership with global financial institutions pursuing a mission to identify, spread, and promote the best environmental and sustainability practices in financial institution operations. The partnership has 207 signatories worldwide, including 18 financial institutions in Japan (as of February 2012).

Principles for Responsible Investment Initiative(PRI)

This initiative was formulated in 2006, with the UNEP FI coordinating the process. The principles are intended primarily for institutional investors, who are urged to observe them when dealing with environmental, social, and corporate governance issues in their asset management. The PRI has 994 signatories worldwide, including 18 investment institutions in Japan (as of February 2012).

Equator Principles(EQUATOR PRINCIPLES)

These principles were formulated in 2003 by 10 major Western financial institutions, with cooperation from the International Finance Corporation in the World Bank Group. They call on banks working in project finance for large-scale development schemes to carry out assessments of the potential environmental and social impacts associated with those projects. A total of 73 institutions worldwide, including three major commercial banks in Japan, have adopted the principles.